Chase CD (Certificate of Deposit) is a popular savings product offered by JPMorgan Chase, one of the leading financial institutions in the United States. This article will explore everything you need to know about Chase CDs, including their benefits, features, and how they compare to other savings options. Whether you are a seasoned investor or someone new to saving, understanding Chase CDs can help you make informed financial decisions.

In the world of personal finance, the right choice of savings instruments can significantly impact your financial health. Chase CDs can provide a reliable way to grow your savings while offering competitive interest rates and predictable returns. However, it is essential to understand the terms, conditions, and potential drawbacks of these financial products before committing your money.

This article will delve into the various aspects of Chase CDs, including their interest rates, terms, and how they stack up against other savings accounts. By the end of this guide, you will have a comprehensive understanding of Chase CDs, enabling you to determine if they are a suitable option for your savings strategy.

Table of Contents

- What is Chase CD?

- Benefits of Chase CD

- How Chase CD Works

- Chase CD Interest Rates

- Chase CD Terms and Conditions

- Comparing Chase CD to Other Savings Options

- Risks of Chase CD

- Conclusion

What is Chase CD?

A Chase Certificate of Deposit (CD) is a type of savings account that holds a fixed amount of money for a specified period, earning interest at a higher rate than a regular savings account. When you open a Chase CD, you agree to leave your money untouched for a predetermined term, which can range from a few months to several years. In exchange, you receive a guaranteed interest rate for the duration of the term.

Key Features of Chase CD

- Fixed interest rate throughout the term.

- Various term lengths available (from 1 month to 10 years).

- FDIC-insured up to $250,000 per depositor.

- No monthly maintenance fees.

Benefits of Chase CD

Choosing a Chase CD comes with several advantages. Here are some of the primary benefits:

- Higher interest rates: Chase CDs typically offer higher interest rates compared to traditional savings accounts, making them an attractive option for savers looking to grow their funds.

- Security: Your investment is FDIC-insured, meaning your deposits are protected up to $250,000, providing peace of mind.

- Predictable returns: With a fixed interest rate, you know exactly how much interest you will earn by the end of the term.

- Flexibility: Chase offers various term lengths, allowing you to choose a CD that aligns with your financial goals.

How Chase CD Works

Understanding how a Chase CD works is essential for maximizing its benefits. Here’s a step-by-step overview:

- Open a CD Account: You can open a Chase CD online, via mobile banking, or in-person at a branch. You'll need to provide personal information and fund the account.

- Select a Term: Choose the term length that fits your financial plans. Chase offers terms ranging from 1 month to 10 years.

- Deposit Funds: Deposit the minimum required amount to fund your CD. Chase typically requires a minimum deposit of $1,000.

- Earn Interest: Your funds will earn interest at a fixed rate for the duration of the term.

- Maturity: At the end of the term, you can withdraw your initial deposit along with the earned interest or choose to roll it over into a new CD.

Chase CD Interest Rates

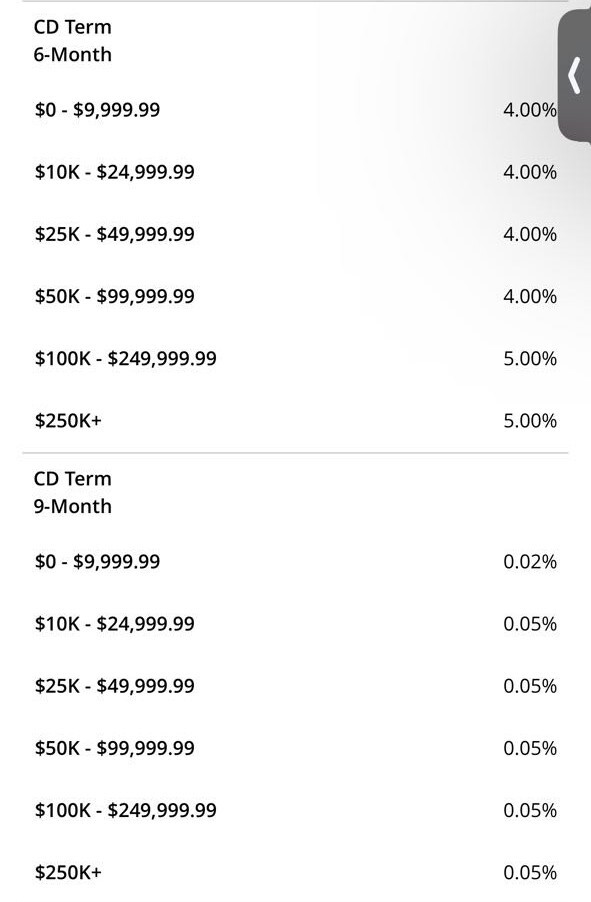

Chase CD interest rates can vary based on several factors, including the length of the term and the overall economic environment. Typically, longer-term CDs offer higher interest rates. Here’s a brief overview of current Chase CD interest rates:

| Term Length | Interest Rate |

|---|---|

| 1 Month | 0.01% |

| 3 Months | 0.02% |

| 6 Months | 0.05% |

| 12 Months | 0.15% |

| 24 Months | 0.25% |

| 36 Months | 0.35% |

Note that these rates are subject to change and may vary based on market conditions. It is advisable to check the Chase website or contact a representative for the most up-to-date information.

Chase CD Terms and Conditions

Before opening a Chase CD, it’s essential to understand the terms and conditions that apply:

- Minimum Deposit: A minimum deposit of $1,000 is generally required to open a CD.

- Early Withdrawal Penalties: If you withdraw your funds before the CD matures, you may incur an early withdrawal penalty, which can reduce your total earnings.

- Automatic Renewal: Most Chase CDs will automatically renew at maturity unless you instruct otherwise.

- Interest Payment Options: You can choose to have your interest paid out monthly or reinvested into the CD.

Comparing Chase CD to Other Savings Options

When considering a Chase CD, it’s helpful to compare it with other savings options:

Chase CD vs. Traditional Savings Account

- CDs typically offer higher interest rates than traditional savings accounts.

- Funds in a savings account are more accessible, while CDs require you to lock in your money for a set term.

Chase CD vs. High-Yield Savings Account

- High-yield savings accounts offer competitive interest rates with more flexibility in accessing your funds.

- CDs provide guaranteed returns but come with penalties for early withdrawal.

Risks of Chase CD

While Chase CDs can be a safe investment, they do carry some risks:

- Inflation Risk: If inflation rates rise above your CD interest rate, your purchasing power may decrease over time.

- Liquidity Risk: Your funds are locked in for the duration of the term, which can be a disadvantage if you need cash unexpectedly.

- Opportunity Cost: If interest rates rise after you open a CD, you may miss out on better returns available in the market.

Conclusion

In conclusion, Chase CDs offer a secure and predictable way to grow your savings, with various terms and competitive interest rates. They can be an excellent addition to your financial portfolio, especially if you prioritize safety and guaranteed returns. However, it’s crucial to weigh the benefits against the potential risks and consider how they fit into your overall financial strategy. If you're interested in exploring further, consider reaching out to a Chase representative or visiting their website for more information.

We invite you to share your thoughts on Chase CDs in the comments below. Have you used a Chase CD before? What was your experience? If you found this article informative, please share it with others who may benefit from this information.

Thank you for reading, and we hope to see you back