The name Jeff Bezos has become synonymous with unprecedented wealth and entrepreneurial success. As the visionary behind Amazon, his journey from a humble hedge funder to one of the world's richest individuals is a testament to innovation and relentless ambition. But beyond the headlines of his vast empire, a particular figure often captures public imagination: his "earnings per second." It's a concept that encapsulates the sheer scale of his fortune, prompting questions about how such immense wealth is accumulated and what it truly signifies.

As we look towards 2025, the fascination with Jeff Bezos's financial standing only intensifies. While pinpointing an exact, real-time figure for "Jeff Bezos earnings per second 2025" remains a complex exercise in projection, understanding the mechanics behind his wealth provides crucial insights. This article delves into the origins of his fortune, the methodologies used to estimate his rapid wealth accumulation, and what the future might hold for the financial trajectory of this iconic American entrepreneur.

Table of Contents

- The Phenomenon of Jeff Bezos: A Brief Biography

- Understanding "Earnings Per Second": More Than Just a Number

- Projecting Jeff Bezos's Earnings Per Second in 2025

- Beyond Amazon: Bezos's Diversified Empire

- The Societal Impact of Extreme Wealth

- The Challenge of Tracking Ultra-High Net Worth Individuals

- Conclusion: A Glimpse into the Future of Wealth

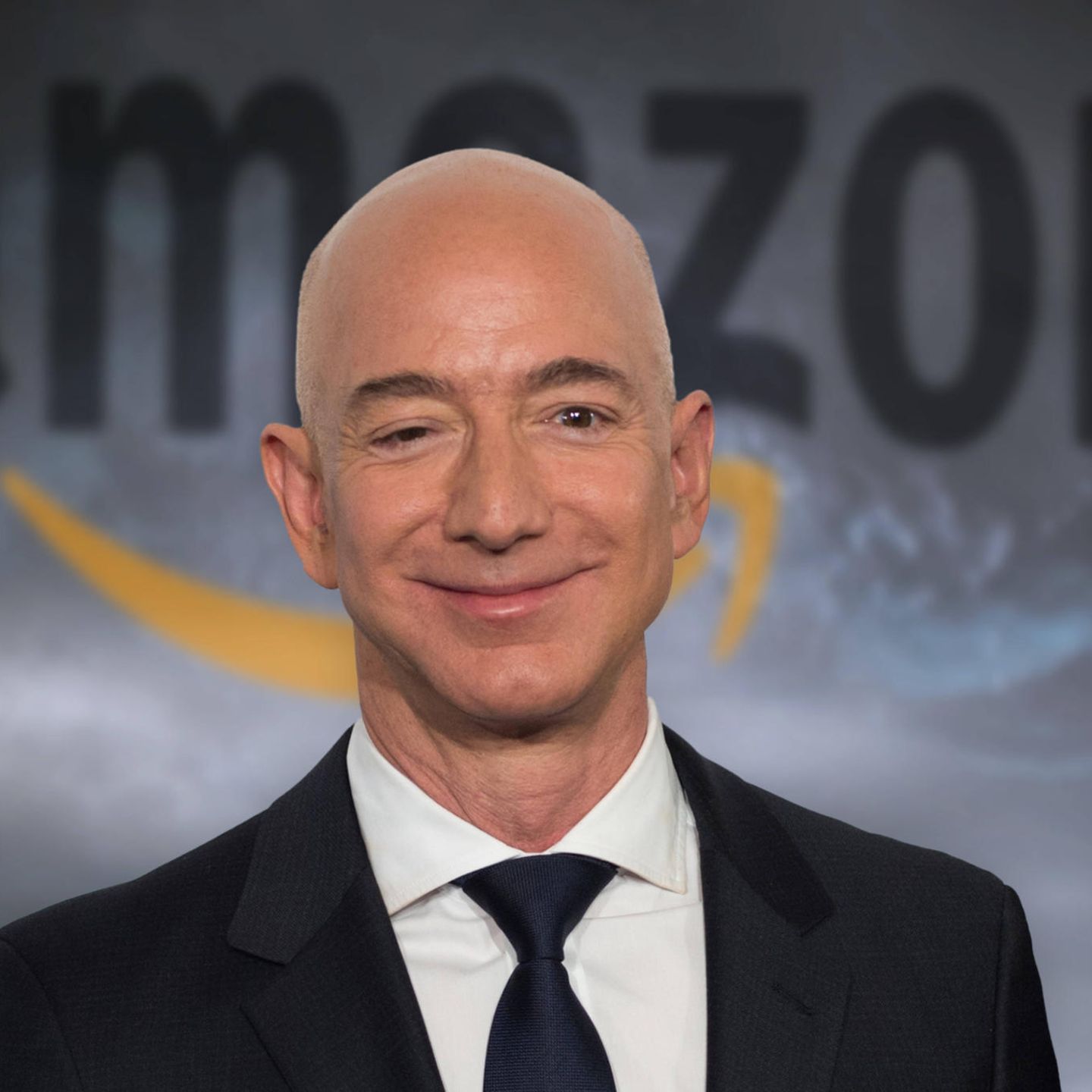

The Phenomenon of Jeff Bezos: A Brief Biography

To truly appreciate the scale of Jeff Bezos's wealth, including figures like his estimated "Jeff Bezos earnings per second 2025," it's essential to understand the man behind the numbers. Born Jeffrey Preston Jorgensen on January 12, 1964, in Albuquerque, New Mexico, his early life gave little indication of the immense global impact he would eventually have. He later adopted his stepfather's surname, becoming Jeff Bezos. His journey began not in e-commerce, but in the fast-paced world of finance. Jeff Bezos began his career as a hedge funder in New York, honing his analytical skills and understanding of market dynamics.

However, a vision for the nascent internet's potential compelled him to leave his lucrative Wall Street career. In 1994, he founded Amazon.com, initially an online bookstore, from his garage in Seattle. What started as a modest venture rapidly expanded into an e-commerce behemoth, transforming how the world shops and consumes media. Bezos's relentless focus on customer obsession, long-term thinking, and aggressive expansion propelled Amazon to unprecedented heights, making him one of the world's richest people. His entrepreneurial spirit didn't stop with Amazon; he also owns Blue Origin, his ambitious aerospace company aiming to make space travel more accessible, and "The Washington Post," a venerable American newspaper he acquired in 2013, revitalizing its digital presence.

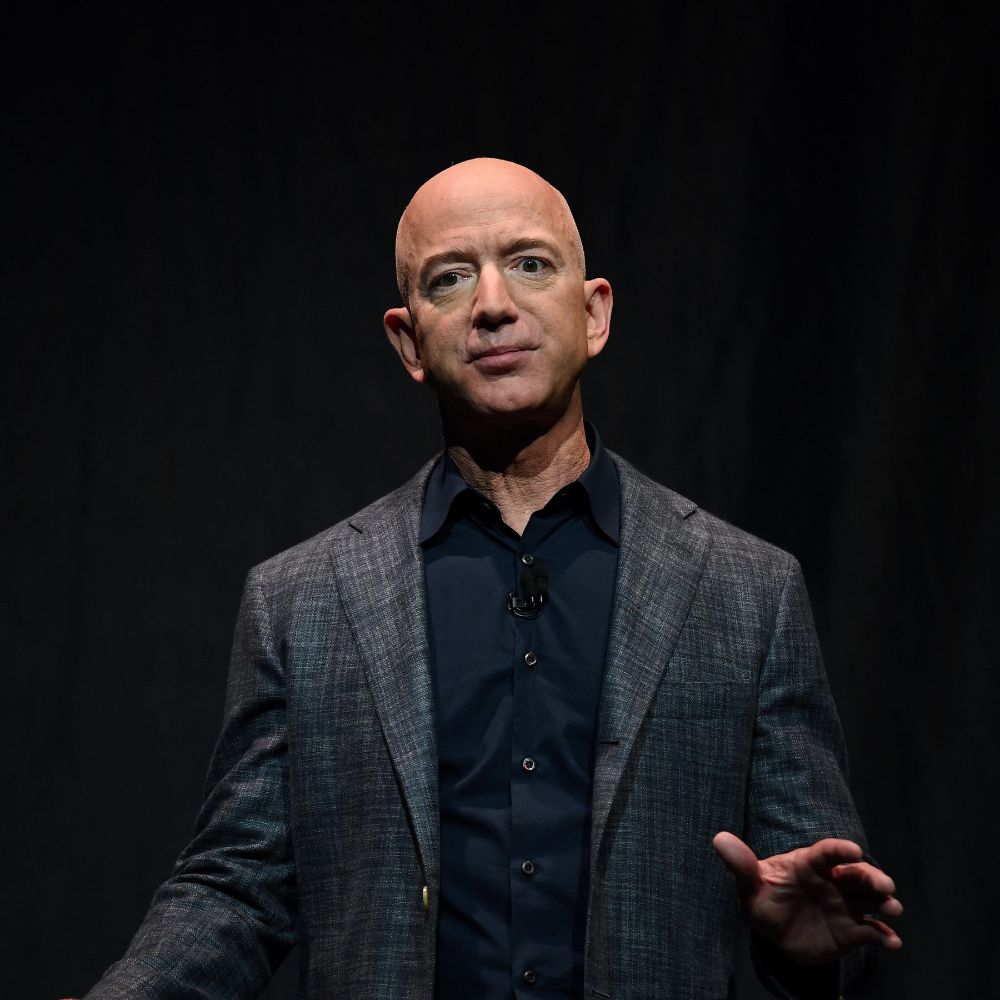

In 2021, a significant shift occurred in his professional life when Bezos stepped down as CEO of Amazon to become Executive Chairman. This move allowed him to dedicate more time to other passions and ventures, including Blue Origin and his philanthropic efforts. Despite this transition, his influence and wealth remain colossal, making any discussion of "Jeff Bezos earnings per second 2025" a fascinating exploration of sustained financial power.

Personal Data & Biodata: Jeff Bezos

| Attribute | Detail |

|---|---|

| Birth Name | Jeffrey Preston Jorgensen |

| Date of Birth | January 12, 1964 |

| Place of Birth | Albuquerque, New Mexico, U.S. |

| Nationality | American |

| Occupation | Entrepreneur, Investor, Founder, Executive Chairman |

| Known For | Founder of Amazon, Owner of Blue Origin and The Washington Post |

| Current Role | Executive Chairman of Amazon |

| Spouse | Lauren Sánchez Bezos (married June 2025) |

Understanding "Earnings Per Second": More Than Just a Number

The phrase "The man who earns per second Jeff Bezos" has become a popular shorthand for extreme wealth. It's a figure that often sparks disbelief and fascination, illustrating the sheer velocity at which a billionaire's fortune can grow. But what does "Jeff Bezos earnings per second" truly mean? It’s crucial to understand that this isn't a direct salary or liquid income flowing into his bank account every second. Instead, it's an estimation derived from the fluctuations in his net worth, primarily tied to the value of his investments and company shares.

- Max Dood Twitter

- Love And Light Tv Yes King Full Video Twitter

- Noah Scurry Twitter

- Baby Gemini Swallowed

- Flo Milli Twitter

Based on publicly available data and analyses of his wealth, Jeff Bezos earns an estimated $2,537 per second. This staggering figure makes him one of the fastest wealth accumulators in history. To break down his annual income that forms the basis of this calculation, it's estimated to be around $798,333,333 a year. This figure is based on his annual earnings and the growth of his assets, primarily his stake in Amazon, but also factoring in his other ventures and investments. When we talk about how much does Jeff Bezos make per second, or how much does Jeff Bezos make a day, we are essentially looking at the average increase in his net worth over a given period, divided by the seconds or days in that period.

Calculating Bezos’ earnings per second involves a sophisticated process. To determine Bezos’ earnings per second, we considered the publicized gross profits and percentages of ownership in his endeavors. Since Amazon’s details are publicly traded, financial analysts can track the company's performance, stock price movements, and dividend payouts (though Amazon historically reinvests profits). This public transparency allows for a relatively accurate estimation of the growth of his primary asset. However, it's vital to remember that this figure is highly dynamic, subject to market volatility, company performance, and broader economic trends. A dip in Amazon's stock price, for instance, could momentarily reduce this "per second" earning rate, while a surge could dramatically increase it.

The Mechanics of Wealth Accumulation

The accumulation of wealth on the scale seen with Jeff Bezos is fundamentally different from traditional income generation. For billionaires, the vast majority of their net worth is tied up in assets, particularly company stock. When Amazon's stock price rises, Bezos's net worth increases proportionally to his shareholdings, even if he hasn't sold any shares. This growth is what contributes to the "earnings per second" calculation. The publicized gross profits of Amazon, coupled with Bezos's significant percentages of ownership in his various endeavors, form the bedrock of these estimations. His wealth isn't just about Amazon, though it's the largest component. It also includes the value of Blue Origin, The Washington Post, real estate holdings, and other investments.

The transparency surrounding Amazon's financial details, as a publicly traded company, allows financial news outlets and wealth trackers to continuously update their estimations of his net worth. They analyze quarterly earnings reports, market capitalization changes, and any significant transactions or divestitures. For instance, if Amazon announces strong earnings, the stock typically responds positively, directly impacting Bezos's net worth. Conversely, market downturns or company-specific challenges can lead to declines. This constant fluctuation means that the "Jeff Bezos earnings per second" is a moving average, a snapshot of his wealth's growth velocity over a specific period, rather than a fixed, guaranteed income stream.

Projecting Jeff Bezos's Earnings Per Second in 2025

Forecasting "Jeff Bezos earnings per second 2025" requires a degree of speculation, as future market conditions and personal decisions are inherently unpredictable. However, we can make informed projections based on current trends and the known trajectory of his ventures. One interesting piece of data points to his continued high-profile status and likely sustained wealth: Jeff Bezos and spouse Lauren Sánchez Bezos leave the Aman Hotel on the third day of their wedding festivities in Venice, Italy on June 28, 2025. This event, scheduled for the future, implicitly suggests a continued lifestyle commensurate with immense wealth, indicating that his financial standing is expected to remain robust.

Several factors will influence whether his per-second earnings in 2025 remain at or exceed the estimated $2,537. Amazon's continued growth is paramount. Despite its maturity, Amazon continues to innovate in cloud computing (AWS), advertising, and new retail formats. Any significant expansion or new revenue streams could further boost its stock price. Blue Origin's progress is another key variable; successful space missions or lucrative contracts could significantly increase its valuation, adding to Bezos's net worth. The performance of The Washington Post, while a smaller part of his portfolio, also contributes. Furthermore, any new ventures or strategic investments Bezos makes through his personal investment firm, Bezos Expeditions, could yield substantial returns. Conversely, economic downturns, increased regulatory scrutiny on tech giants, or unexpected business challenges could temper his wealth accumulation. However, given his track record and the diversified nature of his assets, it's reasonable to expect Jeff Bezos to remain one of the world's wealthiest individuals, with his "earnings per second" likely continuing to reflect an extraordinary rate of wealth accumulation.

Factors Influencing Billionaire Fortunes

The fortunes of billionaires like Jeff Bezos are not static; they are in constant flux, influenced by a complex interplay of market forces, economic conditions, and personal decisions. The primary driver, as discussed, is stock performance. For Bezos, Amazon's stock remains the most significant lever. Its valuation is impacted by consumer spending habits, competitive landscape, technological advancements, and investor sentiment. Beyond his core holdings, investment performance in other assets, such as real estate, private equity, and venture capital, also plays a crucial role. Successful investments can lead to exponential growth, while poor ones can cause declines.

Broader economic shifts, such as inflation, interest rates, and global recessions, can significantly impact asset values across the board. Government policies, including taxation changes (e.g., wealth taxes or capital gains taxes) and antitrust regulations, could also affect how much of his wealth Bezos retains or how quickly it grows. Philanthropy, while not directly impacting his "earnings," can reduce his net worth if large sums are donated. However, strategic philanthropy can also enhance public image and, indirectly, the value of his associated companies. Understanding these multifaceted influences provides a more nuanced perspective on how wealth at this scale is managed and transformed, making the discussion of "Jeff Bezos earnings per second 2025" a dynamic rather than a fixed projection.

Beyond Amazon: Bezos's Diversified Empire

While Amazon remains the cornerstone of Jeff Bezos's colossal fortune, his influence and investments extend far beyond the e-commerce giant. His strategic diversification into other high-impact sectors showcases his long-term vision and entrepreneurial ambition, contributing significantly to his overall net worth and, consequently, his "earnings per second." One of his most ambitious ventures is Blue Origin, his privately funded aerospace manufacturer and space tourism company. Founded in 2000, Blue Origin aims to make space accessible to more people through reusable launch vehicles and advanced space technologies. This is a long-term play, requiring massive investment but holding the potential for astronomical returns as the space economy expands. Its success in 2025 and beyond could be a significant factor in his wealth trajectory.

Another notable acquisition is "The Washington Post." In 2013, Bezos purchased the venerable newspaper for $250 million, injecting capital and digital expertise that revitalized the struggling publication. Under his ownership, The Post has seen a dramatic increase in digital subscriptions and has become a leader in online journalism, demonstrating Bezos's ability to transform traditional industries. While not a direct contributor to his "per second" earnings in the same way Amazon's stock is, its improved valuation and strategic importance add to his overall portfolio. Beyond these high-profile ventures, Bezos Expeditions, his personal investment company, has quietly backed numerous innovative startups and established companies, from Airbnb to Uber, further diversifying his financial interests. This broad portfolio ensures that his wealth is not solely dependent on a single company's performance, providing a buffer against market fluctuations and opening multiple avenues for continued wealth accumulation, which will undoubtedly impact his "Jeff Bezos earnings per second 2025" figures.

The Societal Impact of Extreme Wealth

The discussion around figures like "Jeff Bezos earnings per second" inevitably leads to broader conversations about wealth inequality and the societal impact of extreme fortunes. As one of the richest people in the world, Bezos's wealth is not merely a personal achievement; it represents a concentration of economic power that influences industries, economies, and even political landscapes. The sheer scale of his wealth raises questions about economic systems, the distribution of resources, and the role of philanthropy. While many view such wealth as a product of innovation and market forces, others highlight the growing disparity between the ultra-rich and the rest of the population.

The existence of individuals who can earn thousands of dollars per second, primarily through asset appreciation, underscores fundamental aspects of modern capitalism. It prompts discussions about taxation, labor practices, and corporate responsibility. Bezos himself has engaged in significant philanthropic endeavors, notably the Bezos Earth Fund, a $10 billion commitment to combat climate change, and other initiatives supporting education and homelessness. These actions, while substantial, also highlight the immense resources at the disposal of a single individual. The debate surrounding extreme wealth is complex, touching on issues of fairness, opportunity, and the very structure of society. Regardless of one's perspective, the financial journey of Jeff Bezos serves as a powerful case study in the dynamics and implications of unprecedented wealth in the 21st century, influencing how we perceive and discuss economic power in 2025 and beyond.

The Challenge of Tracking Ultra-High Net Worth Individuals

While we can estimate "Jeff Bezos earnings per second," it's important to acknowledge the inherent challenges in precisely tracking the real-time net worth of ultra-high net worth individuals. Unlike a fixed salary, a billionaire's fortune is largely illiquid, tied up in stocks, real estate, and private investments. The value of these assets fluctuates constantly with market conditions, making any "per second" figure an average or an estimation based on observed trends over a period. Financial publications and wealth trackers, such as those that "View profiles for each of the world’s 500 richest people, see the biggest movers, and compare fortunes or track returns," rely on publicly available data for publicly traded companies and make educated guesses for private holdings. This involves complex calculations of market capitalization, ownership percentages, and assessments of private company valuations.

The methodologies used by different financial outlets can vary slightly, leading to minor discrepancies in reported net worth figures. Furthermore, personal expenditures, philanthropic donations, and private investments are not always immediately transparent, adding another layer of complexity. Therefore, while the estimated "Jeff Bezos earnings per second" provides a compelling illustration of his wealth's growth, it's crucial to view it as a powerful conceptual tool rather than a precise, moment-by-moment financial statement. It serves to highlight the scale of his assets and the velocity at which they can appreciate, rather than representing a literal cash flow into his personal accounts.

The Public's Fascination with Billionaire Wealth

Why are so many people captivated by questions like "how much does Jeff Bezos make per second" or "how much does Jeff Bezos make a day"? This intense public interest stems from a combination of factors. Firstly, it's a testament to the aspirational power of success. Bezos's journey from a garage startup to global dominance inspires many, representing the pinnacle of entrepreneurial achievement. His wealth becomes a symbol of what's possible through innovation and relentless effort. Secondly, there's an element of sheer curiosity about a scale of wealth that is almost unimaginable to the average person. The figures are so astronomical that they defy easy comprehension, leading to a desire to quantify them in relatable terms, even if those terms are still incredibly large.

Beyond inspiration and curiosity, there's also a critical lens through which this wealth is viewed. Discussions about "Jeff Bezos earnings per second 2025" often intertwine with broader societal debates about economic inequality, corporate power, and the responsibilities of the ultra-rich. This fascination reflects a societal reckoning with the implications of such concentrated wealth in a world facing numerous challenges. Ultimately, the public's enduring interest in Bezos's financial standing underscores his continued relevance as a global figure, not just in business, but in the ongoing conversation about wealth, power, and progress.

Conclusion: A Glimpse into the Future of Wealth

The journey of Jeff Bezos, from a visionary founder to an executive chairman overseeing a vast empire, is a compelling narrative of ambition, innovation, and unprecedented wealth accumulation. The concept of "Jeff Bezos earnings per second 2025" serves as a powerful illustration of the velocity at which his fortune, primarily tied to the appreciating value of his assets like Amazon stock, can grow. While the exact figure for 2025 remains a projection, influenced by market dynamics, the performance of his diversified ventures like Blue Origin and The Washington Post, and broader economic trends, it is built upon a foundation of immense, sustained wealth.

As we move towards and beyond 2025, Jeff Bezos will undoubtedly remain a central figure in discussions about global wealth, technological advancement, and the future of commerce and space exploration. His financial trajectory will continue to be a subject of fascination, offering insights into the mechanics of extreme wealth and its broader societal implications. The man who earns per second Jeff Bezos will continue to resonate as a symbol of both extraordinary success and the complex realities of modern capitalism. To delve deeper into his remarkable story and ongoing ventures, we encourage you to read more about Bezos, here. What are your thoughts on the future of wealth accumulation and the role of figures like Jeff Bezos? Share your insights in the comments below!

Related Resources:

Detail Author:

- Name : Dr. Dandre O'Conner

- Username : kilback.felicita

- Email : dino.conn@ryan.com

- Birthdate : 1977-07-21

- Address : 5409 Tromp Knolls New Destineyville, ME 40236

- Phone : 614.560.6109

- Company : Gutmann Ltd

- Job : Scientific Photographer

- Bio : Eius eveniet facilis non esse. Ut necessitatibus dolores architecto accusantium et dolores. Consequatur reprehenderit culpa veritatis error laborum ex exercitationem et.

Socials

tiktok:

- url : https://tiktok.com/@tomas.conroy

- username : tomas.conroy

- bio : Ut explicabo perspiciatis animi. Ea sequi sint iure soluta.

- followers : 1542

- following : 1646

linkedin:

- url : https://linkedin.com/in/tomas_conroy

- username : tomas_conroy

- bio : Eum dicta est soluta.

- followers : 4522

- following : 2170